Supply Chain Management Software Report 2H2025

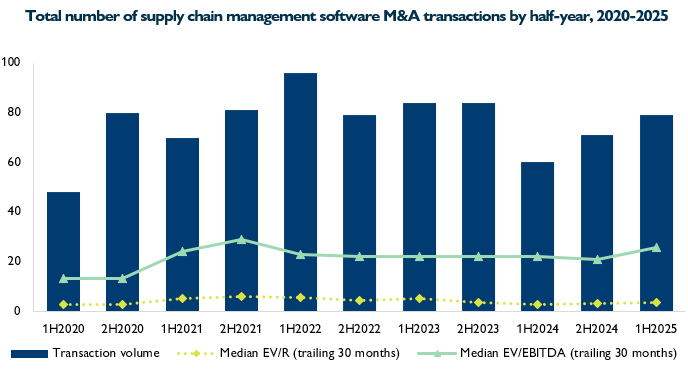

Our latest Supply Chain Management Software (SCMS) M&A report highlights a continued resurgence in deal activity. The first half of 2025 saw transaction volumes rise for the second consecutive period following a temporary dip in 2024. The SCMS market has maintained strong momentum since the initial surge in dealmaking during the first year of the pandemic, reflecting the transformative digitalisation of supply chains in recent years. M&A is now further fuelled by advances in AI and robotics, while valuation multiples remain more restrained than during the pandemic-era buying boom, signalling a focus on profitability and resilience over long-term growth potential.

Companies are using acquisitions to strengthen supply chain management, logistics, and software capabilities. Key drivers include agentic AI, which can automate critical processes, cybersecurity as broader SCM adoption increases risk exposure, and ESG-related technology that supports sustainability tracking and reporting. Consolidation and ongoing buy-and-build strategies continue to sustain M&A momentum across the sector.

The report covers key subsectors within Supply Chain Management Software, including Logistics Software, Supply Chain Analytics, Warehouse Management, Procurement & Supplier Relationship Management and Inventory Management.

Key topics addressed in the report include:

- Trends and analysis of M&A activity

- Most active acquirers and deal highlights

- Valuation insights and metrics

Top Buyers

The above graph covers the period between January 2020 and June 2025. Throughout the M&A report, median “trailing 30-month” multiples plotted in the graphs refer to the 30-month period prior to and including the half year or quarter.