IT & Business Services Report 1H2026

Our 1H 2026 IT & Business Services M&A Market Report shows a clear momentum rebound, but the rules of the game have changed. Deal activity is holding up strongly versus 2024, yet buyers are no longer paying for storylines or headcount-led expansion. Instead, they are underwriting transactions around what can be delivered post-close: execution certainty, margin transparency, and integration readiness. The result is a “quality-first” market where select assets command resilient pricing, while anything operationally messy gets discounted fast.

One shift stands out: generative and agentic AI has moved from differentiator to table stakes across enterprise service platforms. Acquirers are rewarding AI only when it translates into hard operating outcomes, such as delivery automation, higher utilisation, and shorter cycle times. At the same time, AI-powered threat escalation is pulling cybersecurity to the centre of board agendas. Identity and observability are becoming core platform pillars, and consolidation among security specialists is accelerating. Regulatory and compliance demands are also rising, extending diligence focus to data architecture and increasing the importance of post-merger integration planning.

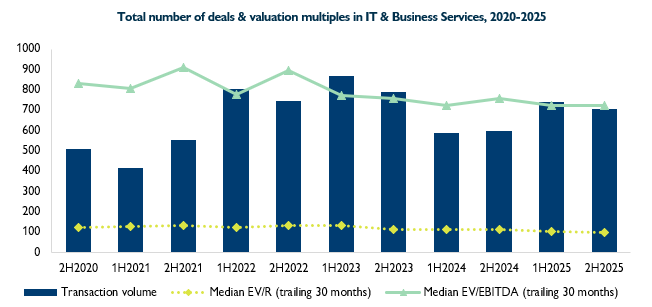

The report breaks down the most active subsectors, including Tech Services & Support, IT Outsourced Services, and Integration Services, and maps how ecosystem-led roll-ups around Microsoft, Salesforce, ServiceNow, SAP, and Atlassian continue to fuel M&A. It also highlights a growing valuation split: revenue multiples remain pressured, while profitability-linked pricing is proving far more resilient, reinforcing the market’s pivot from “paying for growth” to “paying for conversion.”

Key topics addressed in the report include:

- Trends and analysis of sector M&A activity, including the shift from AI hype to execution-driven consolidation

- Valuation insights across EV/revenue and EV/EBITDA, and what buyers are rewarding in 2026

- Ecosystem-led M&A dynamics around major enterprise platforms and certified service providers

- Subsector deep-dives across Tech Services & Support, IT Outsourced Services, and Integration Services, plus notable acquirers and transactions

Top Buyers

The above graph covers the period between July 2020 and December 2025. Throughout this M&A report, median “trailing 30-month” multiples plotted in the graphs refer to the 30-month period prior to and including the half year.