Autotech & Mobility Report 1H2026

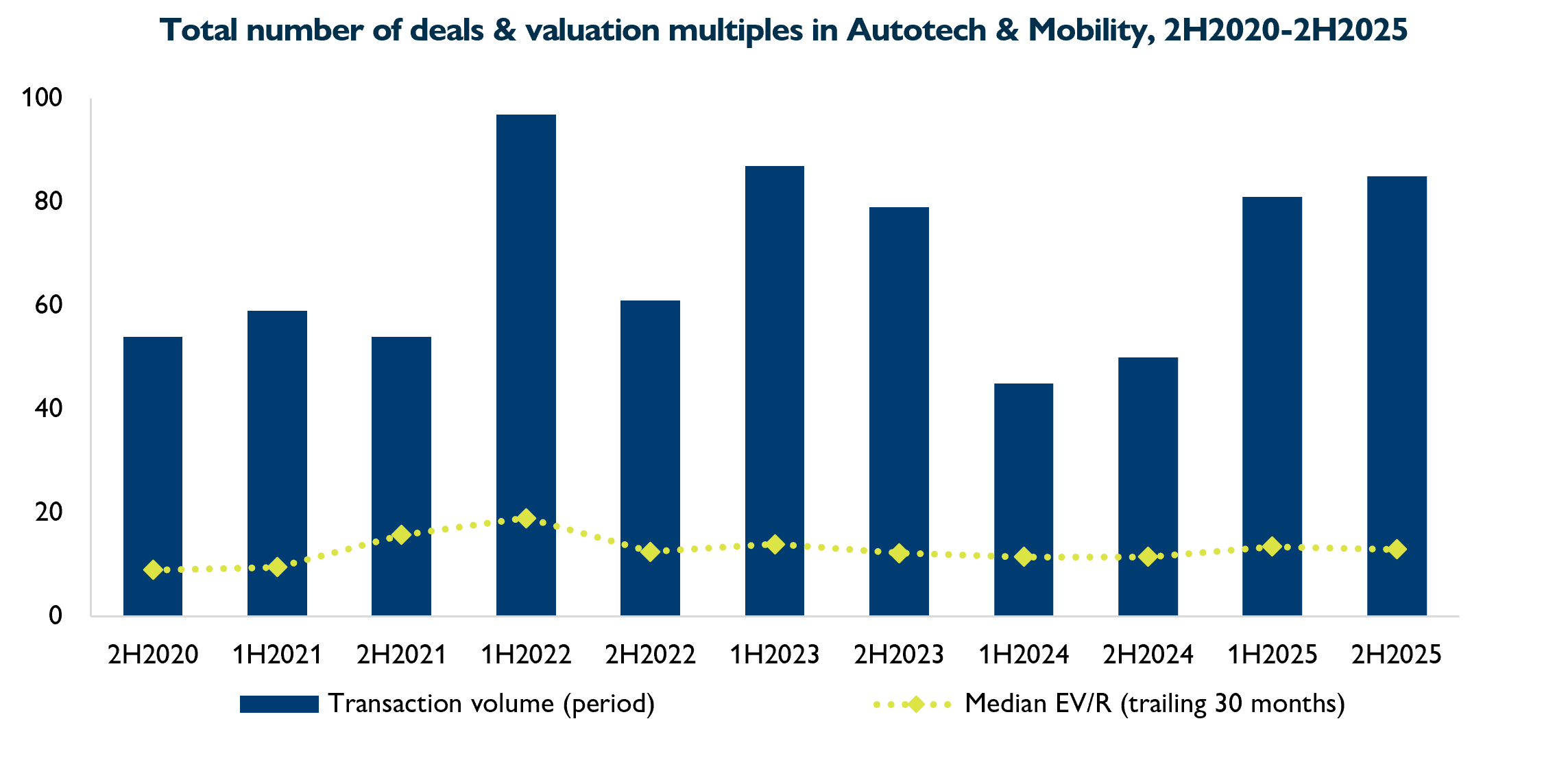

Our latest Autotech & Mobility M&A report shows that dealmaking in the sector has regained strong momentum. After a cautious 2024, deal activity rebounded strongly over the past 12 months — matching the previous peak in 2023 . The rebound is being fuelled by the rapid shift toward software-defined vehicles, rising EV adoption, and ongoing consolidation as OEMs, Tier 1 suppliers and platform providers expand capabilities through M&A.

Michael Brecht, Sector Principal for Mobility & Infrastructure at Hampleton Partners, said: “The steady pivot from combustion to electric engines, the AI-enhancement of dealership, mobility and logistics management platforms, plus the proliferation of the ADAS tech stack to include ever-more sophisticated applications, all add up to a sector undergoing the kind of disruption which motivates acquirers to aggressively secure technology and market share.”

EV adoption and consolidation power the next wave

Buyer demand continues to be driven by electrification and embedded software systems — spanning battery management, telematics, ADAS and charging. Europe’s EV transition remains a key catalyst, with battery-electric vehicles accounting for ~17.4% of new EU passenger car registrations in 2025, up from ~13.6% in 2024, alongside rising electrification in buses, trucks and charging infrastructure. At the same time, the charging market is shifting from fragmentation toward partnership-led scale, accelerating strategic M&A across the ecosystem.

Key topics addressed in the report include:

- Trends and analysis of M&A activity

- Transaction overview by region and subsector

- Most active acquirers and deal highlights

- Valuation insights and metrics

Autotech & Mobility remains one of the most strategically important technology-driven markets shaping the automotive value chain.

Hampleton Expands Its Automotive & Mobility Practice – Meet our New Sector Principal

Hampleton Partners welcomes Horst Bardehle as the new Sector Principal for Automotive. With more than 30 years of senior leadership experience in the automotive industry, Horst will advise OEMs, suppliers and technology-driven mid-sized companies as they navigate transformation and consolidation. Michael Brecht continues as Sector Principal for Mobility & Infrastructure with a focus on software and charging solutions.

Selected Buyers of Highlight Transactions

The above graph covers the period between July 2020 and December 2025. Throughout this M&A report, median “trailing 30-month” multiples plotted in the graphs refer to the 30-month period prior to and including the half year.