Enterprise Software M&A Report 1H2026

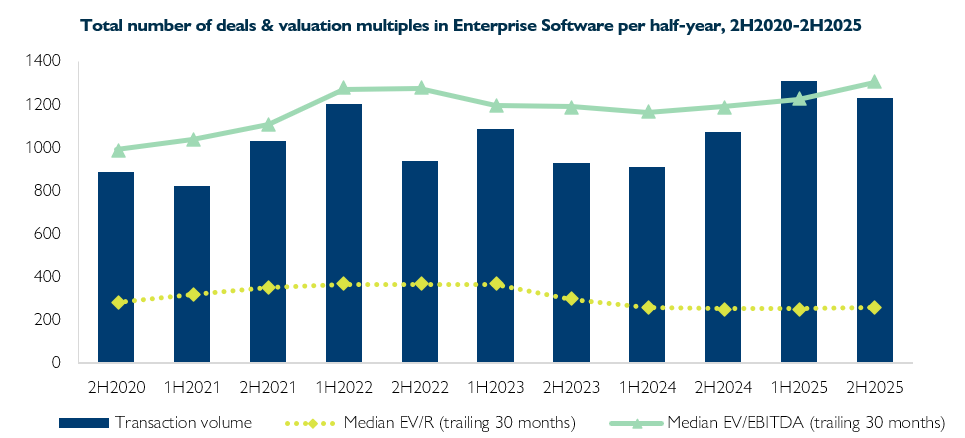

Our latest Enterprise Software M&A report highlights that dealmaking in the sector remains extremely active and highly valued. With 2,452 deals completed in 2025 — the highest number ever recorded in a single year the second-highest half-year total ever—both strategic and financial buyers are competing aggressively to acquire the most innovative companies.

Miro Parizek, founder and senior partner at Hampleton Partners, notes: “Strategics are leveraging M&A as stealth R&D to expand platform capabilities and acquire top talent, while private equity pursues aggressive buy-and-build strategies, particularly in emerging markets.”

AI and real innovation drive M&A

The AI hype is cooling, and buyers are becoming more selective. Only companies that demonstrate genuine AI integration, measurable efficiency gains, and sustainable monetization are commanding strong buyer interest. Hype alone won’t secure a deal—real innovation continues to reward companies in this highly competitive sector.

The report covers key subsectors of Enterprise Software, including Enterprise Applications, Vertical Applications, Business Intelligence & Customer Analytics, Information Management, Infrastructure Management and Design, Testing & Simulation.

Key topics addressed in the report include:

- Trends and analysis of M&A activity

- Transaction overview by region

- Most active acquirers and deal highlights

- Valuation insights and metrics

Enterprise Software remains one of the most resilient, liquid, and strategically critical sectors in tech. Deals are happening fast—and the companies leading the market are already pulling ahead.

Top Buyers

The above graph covers the period between July 2020 and December 2025. Throughout the M&A report, median “trailing 30-month” multiples plotted in the graphs refer to the 30-month period prior to and including the half year or quarter.